California Health Insurance Mandate For Employers

The state of california adopted a new state individual health care mandate that requires individuals to maintain health insurance beginning january 1, 2020. Many employers are starting to prepare for the first filing deadline of march 30, 2021.

US retroactively extends tax credits for charger

Mandated insurance benefits and the cost of health insurance.

California health insurance mandate for employers. The affordable care act (aca) mandates that larger employers (50 or. On june 27, 2019, california gov. Compliance snapshot starting in 2021, employers will have reporting and notice obligations under the new california individual mandate law.

Employers want to offer health insurance to their employees and want to continue to grow and create jobs. Employers with 100 or more employees must have registered for the program by september 30, 2020. This is where we actually have some new requirements.

The is currently no requirement for california employers to provide health insurance for their employees. Employers have different deadlines to comply with the mandate, according to the size of their workforce. For employers who don't currently offer a group plan, this new law is going to motivate them to offer substantial coverage for their employees.

It's more a question of avoiding a penalty but the penalty plus the tax deductibility of health insurance definitely makes it advantageous to offer coverage. Defined under health and safety code section 1345.5, california mec was created in the image of the aca. California individual health coverage mandate includes employer reporting.

There is an exception for religious employers. This is known as the employer mandate. 38, sb 78) requires state residents to maintain minimum essential coverage (mec) for themselves and their dependents starting on jan.

Most people—whether for or against mandates—agree that mandated health benefits increase health insurance premiums. For employers with fully insured plans, most insurance carriers will submit forms 1094 and 1095 to the state and. California was among the states that passed an individual mandate (california mandate) that required residents to maintain minimum essential coverage (mec) starting january 1, 2020.

(1) the specifics of the mandate and (2) what one assumes about the dynamics of wages, fringe benefits, and employment. Requirement for california companies with 50+ employees. California is implementing its new state individual mandate in 2020.

Depending on the mandated benefit and how that benefit is defined, the increased cost of a monthly premium can increase from less than 1% to more than 5%. The estimated impact of an employer health insurance mandate on insurance coverage and employment depends on two sets of factors: Specific mandate proposals vary widely from state to state.3 most include

Beginning january 1, 2020, all california residents must maintain minimum essential health insurance coverage for themselves and their dependents. The information must be furnished to employees by january 31, 2021 and filed with california’s franchise tax board by march 31, 2021. However, the employer mandate threatens to penalize businesses for failing to offer affordable coverage, when—more than ever—people need jobs and employers need help growing and should be encouraged to hire more employees.

The california individual health coverage mandate is modeled after the individual mandate that was initially part of the affordable care act but that was later repealed under president trump. Under the new aca law rules, a company with 50+ full time equivalents has to offer aca compatible coverage to full time. What small businesses need to know about the employer mandate.

1, 2020, or pay a state tax penalty. California’s new individual health insurance mandate (2019 ch. The legislation also establishes a.

The internet website of the franchise tax board is designed, developed and maintained to be in compliance with california government code sections 7405 and 11135, and the web. Individuals who do not obtain health insurance for themselves and their dependents will be subject to a penalty unless they qualify for an exemption. After the affordable care act (aca) individual mandate penalty was reduced to $0 in 2019, states began passing their own individual mandates that penalized residents for failing to maintain healthcare coverage.

Details on the new reporting mandate and how to report health insurance information. Employers also have new responsibilities under california’s new health care law. Employers with california employees will experience two main consequences under the new state mandate.

Starting july 1, 2020, the california paid family leave program will provide up to 8 weeks (increased […]

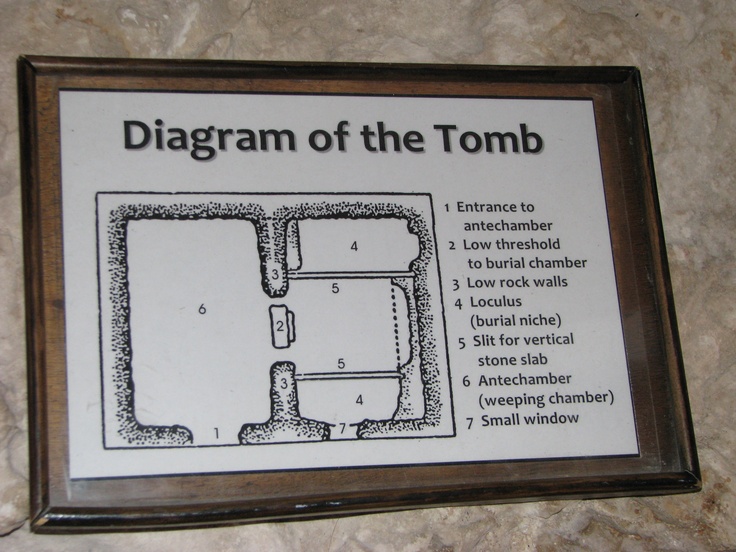

A diagram of the tomb where Jesus may have been lain after

"You Show. We Pay." SIDESTEP Fotos